When we talk with seniors and their families, we find that they all have the same question: how can they finance long-term care? Whether they are planning on living at home or moving into an independent or assisted living facility, outside of private resources or long-term care insurance, there are very few ways to finance this care.

For veterans and spouses of deceased veterans, the Veterans Pension and Survivors Pension benefit programs are great options. These programs provide a monthly cash benefit to the veteran or his or her surviving spouse. We’ve gathered the most common questions we receive about the VA pension (properly known as an “Improved Pension”) and provided brief responses to each.

What is a “pension”?

When most people think of a pension, they think about receiving a monthly payment from their employer. In this case, we are really talking about an “improved pension benefit” which is a need-based monthly payment made to eligible veterans. The amount a veteran receives will depend on the amount of that person’s monthly income (minus medical expenses) and the type of pension.

What types of improved pension benefits does the Department of Veterans Affairs (VA) offer?

- Basic improved pension: pays a monthly cash benefit

- Homebound benefit: pays the basic improved pension plus a subsidy to individuals who are substantially confined to their immediate premises (i.e. homebound) because of a permanent disability

- Aid & Attendance benefit: pays the basic improved pension plus a larger subsidy to an individual who requires assistance with 2 or more activities of daily living, requires protection from the hazards of the daily environment, is completely bedridden, is a patient in a nursing home due to physical or mental incapacity, or is blind as defined in the Veteran Health Administration regulations.

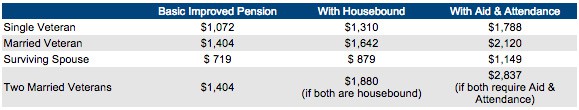

Table: 2015 Veterans Pension Benefits (Monthly)

Credit to Krouse Financial Services

Most potential clients who contact our office are interested in receiving the full Aid & Attendance benefit because it pays considerably more than the basic improved pension. However, it is important to remember that as long as a veteran or a surviving spouse is over age 65, that individual qualifies for a VA pension benefit even if he or she has no disabling medical condition.

What are the eligibility requirements for benefits?

The veteran must meet all of the criteria outlined below:

- The veteran must be totally and permanently disabled or over age 65 at the time of application.

- The veteran must not have been dishonorably discharged.

- The veteran must have served 90 or more consecutive days of active duty, at least one day of which was during a period of war. Individuals who joined the military after September 8, 1980, have additional service requirements.

- The individual must have limited income and net worth that is inadequate to meet his needs.

Do I make too much money to qualify?

The VA employs a formula to determine whether your income is too great to qualify for this benefit. Basically, the VA looks at your household’s “countable” income and offsets your prospective medical expenses against that income. If the remaining income is less than the potential benefit amount, the veteran or surviving spouse will receive the difference between the countable income after the offset and the benefit.

For example, a single veteran whose medical condition qualifies for the Basic Improved Pension plus Aid and Attendance benefit is eligible to receive up to $1,788 each month in 2015. This veteran lives at home, receives $2,000 in Social Security each month, and spends $800 to see a doctor every month. The VA will offset the cost of the doctor visit against his income, and he will be deemed to have an income of $1,200. Thus, he will receive a monthly VA pension check of $588. If he lived in a nursing home that costs $6,000 each month, he would have a net income of $0, and he would receive the full $1,788 benefit. (Okay, the actual calculation used is slightly more complicated than this, but you get the idea.)

What about my bank accounts and other assets? Can I still qualify for benefits if I have savings?

If the VA determines that an applicant has a “sufficiently large amount of assets” that he can live off of for a “reasonable period of time,” the veteran will not be eligible for the improved pension benefit. Because of inconsistencies as to how “sufficiently large amount” and “reasonable period of time” can be interpreted, we look at the applicant’s financial resources to see what we can do to help someone qualify for benefits. Sometimes we recommend that assets be converted to income streams, such as an annuity, that assets be given to individuals or a trust, or that assets be used (spent down) to meet the senior’s other needs.

What if the veteran’s spouse is the one who has the need?

The VA program focuses on the need of the veteran first, not the spouse. When the veteran dies, the VA will look to the need of the spouse. If there’s a divorce or if the spouse remarries after the veteran passes away, the veteran’s former spouse is usually not eligible for VA pension benefits.

Why does Medicaid come up when I’m not interested in putting my spouse or parent into a nursing home?

We often hear from clients that they promised a parent or a spouse that they would never put that parent or spouse in a nursing home. Unfortunately, clients are not always able to keep that promise. The parent or spouse may have a stroke or develop another medical condition that requires more care than an assisted living facility can provide. Sometimes the parent or spouse has used so much of his savings that he or she can no longer afford the cost of an assisted living facility. And, often, the VA benefit is simply not enough to pay the private rate for a nursing home facility. Unfortunately, VA and Medicaid statutes and regulations do not work well together. Because these statutes conflict and because we are acutely aware of the possibility of someone needing nursing home care, I always recommend that our plans consider how VA eligibility will impact an individual’s Medicaid eligibility and what can be done if a senior has to move between benefits. Thus, we review both VA and Medicaid eligibility when we work with our clients.

Do you anticipate changes in the administration of VA benefits?

Yes. In January 2015, the VA proposed regulations that create a formula calculating income and assets for purposes of eligibility. The proposed regulations also will impose transfer penalties if assets are given away by the veteran within three years prior to the application. The public response to these proposed regulations were overwhelming – over 800 comments were submitted. The general thought is that the VA may take several years to review the comments, and it may modify the regulations depending on the response. While having a a fixed income and resource standards will help with planning in the long run, we still recommend that people who may be thinking about VA benefits for themselves or their parents seek assistance from a VA-accredited attorney now to take advantage of the current lack of transfer penalties for gifts.

Can you help me complete my application for benefits?

We are able to assist you with your application at no charge (per Federal statute and regulations) if we have helped you determine your eligibility first.

The area of long term care planning, including planning to receive Veterans Pension benefits, is complicated and fraught with traps for the unwary and unknowledgeable. If you have questions about whether a VA Pension is appropriate for you or your family, please contact our office to set up an appointment with VA Accredited attorney, Diane Weinberg, at 678-720-0750 or send an email to ABrayle@MorganDiSalvo.com.