What is this? This Quick Assessment Tool can be used to get a generalized answer as to how to deal with the Setting Every Community Up for Retirement Enhancement (SECURE) Act effects on your IRA and Qualified Retirement Plan (“retirement plan”) accounts under your estate plan (“EP”).

We still recommend that you review both the SECURE Act Q&A and SECURE Act Self-Assessment Tool / Full Discussion documents to better understand the issues and the most viable options in your situation. And, of course, this Tool is being provided for educational purposes only and you should seek specific guidance from your own legal counsel who can provide individualized advice in your particular situation.

Table of Contents

Step 1: How would you like to pass your assets to your loved ones?

Step 2: Let’s first figure out what to do in the relatively easy situations.

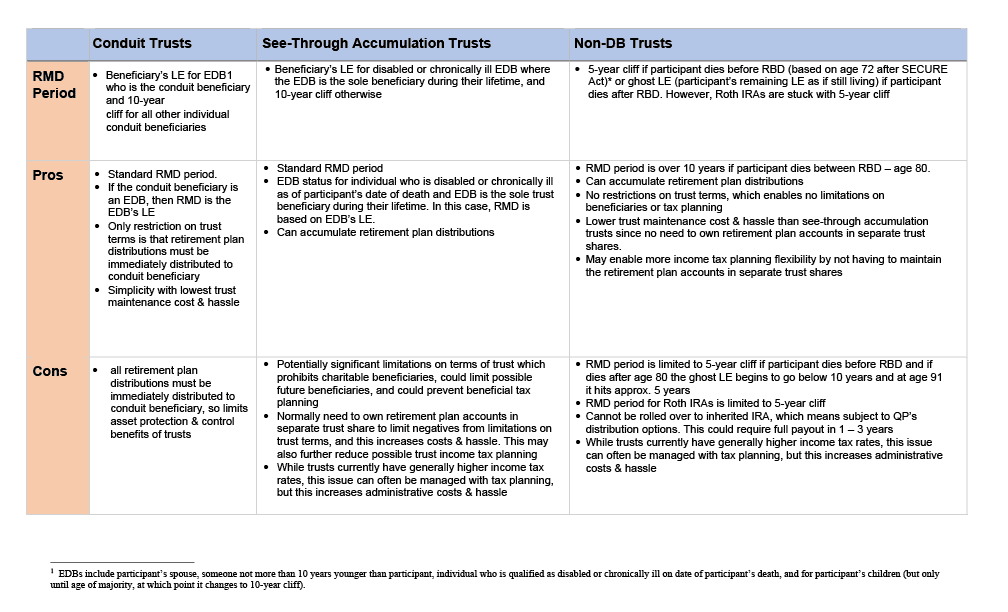

Step 3: Where using or would like to use long-term trusts, dynasty trusts or SNTs, the analysis becomes more complex as you need to weigh the pros cons of each option in your particular situation.

Step 4: Consider the following factors, among others, to assist in analyzing which trust option is best for RMD purposes.

Step 1: How would you like to pass your assets to your loved ones?

The first step is to determine how your EP documents currently pass your assets to your loved ones at your death. If you would like to change how this is being done, then you need to update your EP. However, if you still agree with how you are passing your assets to your loved ones, then you need to go to the next step. The different ways to pass assets to your loved ones, include: (i) outright; (ii) short-term trusts;1 (iii) long term trusts;2 (iv) dynasty trusts;3 and (v) special or supplemental needs trusts (“SNTs”).4

Step 2: Let’s first figure out what to do in the relatively easy situations.

A. Desire to transfer all wealth outright: Good to go!

You just need to be sure that your intent is properly reflected by the retirement plan trustee or custodian. The one legal impediment is if you are married and you want to benefit someone other than your spouse with your Qualified Plan (“QP”) account, then you will need your spouse’s written consent on the proper forms through the plan trustee or custodian.

B. Desire to utilize short-term trusts to pass your retirement plan accounts to your non-spouse loved ones.

i. Benefitting legal children.

Conduit trust planning is likely the best answer as long as ok with all of each child’s share of your retirement plan accounts passing to them outright by as early as age 28.5 If not, then conduit trusts should not be used.

ii. Young beneficiary who is not your legal child.

Utilizing conduit trusts for RMD purposes may not be the right answer where an intended beneficiary is young and is not your legal child, which could include for example, your grandchild, step-child, or niece or nephew. This beneficiary will receive all of their share of your retirement plan account within 10 years after your death regardless of their age.6

iii. Older individuals where still need short-term trusts.

Where the desired individual beneficiaries are old enough that 10 years of trustee control is sufficient before a full payout is required, using conduit trusts is likely the right answer.

Step 3: Where using or would like to use long-term trusts, dynasty trusts or SNTs, the analysis becomes more complex as you need to weigh the pros cons of each option in your particular situation.

*The RBD is April 1st of the year after the participant turns age 72.

Click the image above to download a print-friendly PDF

Step 4: Consider the following factors, among others, to assist in analyzing which trust option is best for RMD purposes.

1. Concerns with see-through accumulation trusts.

How important are the changes required to trust’s substantive terms to qualify as a see-through accumulation trust? How important is it to retain the ability to undertake future tax planning? If these needed changes are deemed important, a see-through accumulation trust may not be a viable option. A possible option may exist to have the retirement plan assets set aside in a separate trust to minimize the effect of the see-through trust limitations. However, this will increase the costs and hassle in administering the trust(s) and may further reduce possible trust income tax planning.

2. What type of retirement plans are involved?

QPs and Roth IRAs are not treated as well with non-DB trusts. Significant QP amounts may disqualify a non-DB trust as a viable option before the participant’s retirement and rollover of their QP amounts to IRAs.

3. Are retirement plans significant in amount and/or in relation to overall wealth?

If the retirement plans are not significant, then using a conduit trust or non-DB trust may be the right answer even though it might not otherwise be if the retirement plans were significant.

4. What are ages of non-spouse beneficiaries, and if young, are they the participant’s legal children?

This factor may be important in deciding if conduit trusts are a viable option.

5. What are the of the ages of participants and their spouse?

This factor is important in deciding if a non-DB trust is viable.

6. Is it important to benefit from EDB status?

Can only get the benefit of EDB status while using a trust as the retirement plan beneficiary if using a conduit trust, except for disabled or chronically ill, who can use a special see-through accumulation trust.

7. How important is it to maximize the asset protection and control benefits of trusts?

If desired to maximize these powerful benefits, then the only viable options are the see-through accumulation and non-DB trusts.

8. What is the likelihood that one or more of the intended beneficiaries is or may become disabled or chronically ill by the date of the participant’s (or if married, the surviving spouse’s) death?

This will help determine if the specialized see-through accumulation trust should be considered in order to benefit from possible EDB status.

9. How important is it to provide for charity via the trust, either as a contingent beneficiary or otherwise? Also, is providing for heirs (closest family of self, spouse and/or another person) a desirable option as the contingent beneficiary?

A see -through accumulation trust prohibits benefiting charity and effectively requires using heirs (with some ability to modify the definition) as the contingent beneficiaries. If these limitations are not desirable, then a see-through trust may not be a viable option.

10. How important is it to permit the beneficiary (e.g., child) to have the power to change how any remaining trust assets pass at their death, among non-descendants?

If this is important, a see-through accumulation trust may not be viable or very careful drafting will be needed.

11. Is it important for the trust to include the flexibility to enable future tax planning to get a step-up in income tax basis at a beneficiary’s death?

If yes, then a see-through accumulation trust may not be a viable option.

12. How important is minimizing the costs and hassle of trust administration?

If it is important, a see-through accumulation trust may not be as viable since it will often require that the retirement plans be owned in a separate trust share to reduce the negative effects of the see-through accumulation trust limitations. In addition, both see-through accumulation and non-DB trusts may need more effort to manage the annual income tax rates on income that does not otherwise need to be distributed to a beneficiary during the year.

2Assets are managed in trust for the beneficiary’s benefit throughout the beneficiary’s lifetime, and will normally pass to the beneficiary’s children thereafter in a manner similar to a short-term trust. Long-term trusts are used to provide asset protection and control benefits, and to some extent, tax benefits. The asset protection benefit can protect the assets you are passing to your beneficiaries from their unwanted outsiders, including spouses in divorce situations, judgement creditors, personal guarantees, bankruptcy and predators. When the beneficiary is a mature age, such as age 35, the beneficiary can serve as the trustee of their own trust share (to maximize their control) or a third party can remain the trustee throughout the beneficiary’s lifetime. The beneficiary is normally given the power to modify how the assets will pass at their death, including the ability to extend the terms of the trust for their descendants.

3Dynasty trusts are similar to long-term trusts, except that the trust(s) continue on until the sooner of the trusts running out of funds or the Rule Against Perpetuities (“RAP”), which in GA is 360 years for trusts created on or after July 1, 2018, and effectively 90 years for trusts created before this date. Dynasty trusts do not require the beneficiaries to act to extend the trusts.

4Special or supplemental needs trusts (“SNTs”) are essentially long-term trusts that are specifically structured to enable a disabled or otherwise special needs beneficiary to benefit from an inheritance without having this benefit affect their ability to receive any means tested government benefits, such as Medicaid.

5A participant’s minor child is an Eligible Designated Beneficiary (EDB) who has Required Minimum Distributions (RMDs) based on their LE until the age of majority (as modified) and then the 10-year cliff rule applies thereafter.

6If the beneficiary is below age 18, the assets will be controlled on the beneficiary’s behalf by a custodian (for smaller amounts) or a conservator under the supervision of the probate court (for larger amounts). Upon attaining age 18 – 21, depending on the state, the beneficiary will then have full access to the funds.