In Part 1 of this three-part newsletter series, we discussed how right now may be the perfect time to undertake advanced estate planning transactions. Why? The reasons include historically low interest rates, relatively low and volatile asset valuations, and an expectation of higher taxation on the horizon. In Part 2, we discussed the reasons for undertaking this type of planning, who should be doing it and to what extent.

In this Part 3, we will be discussing the most important estate planning strategies to consider at this time.

I. Gifts and Loans

You now have the enhanced ability to help loved ones with tax free or taxable gifts and loans with historically low interest rates.

A. Tax free gifting

Utilizing tax free gifting is not an advanced estate planning technique, but it is always an important strategy to consider. Tax free gifting includes: (i) annual exclusion gifts (“present interest” gifts up to $15,000 per year from each donor to each beneficiary, so spouses can utilize twice this amount) ; (ii) unlimited tuition for schooling and health care expenses, but these amounts must be paid to the provider (school or health care provider or health insurance company) on the intended beneficiary’s behalf rather than directly to the intended beneficiary; and (iii) unlimited amounts to a spouse and charitable organizations.

B. Taxable gifting

Taxable gifting utilizes your (and your spouse’s) available basic exclusion amount (BEA). Even though taxable gifts are taxable, no tax amount is actually due to be paid unless and until you have total taxable gift and estate transfers that exceed your BEA amount. We discussed the BEA amount in Part 2 of this newsletter series. Under the temporary 2017 Tax Act, the BEA is $10 million indexed for inflation ($11.58 million in 2020), but is scheduled to return on January 1, 2026 to the 2012 Tax Act’s BEA amount of $5 million indexed for inflation (which is estimated to be about $6.5 million at that time). Each spouse in a married couple gets their own BEA amount, and is able to pass any unused BEA amount at their death to their spouse if the portability election is made by timely filing an IRS Form 706, Estate Tax Return.

Depending on your situation, it may make a lot of sense to partially or fully use your BEA (or possibly both spouses’ BEA amounts for married couples) before the BEA is essentially cut in half. See Part 2 of this newsletter series for a discussion of when the BEA may change and to what amount.

Taxable gifts can be made outright or in various types of trusts. However, making gifts in trust will normally maximize the benefits of gifting.

If you are not sure if you really want or need to make a large taxable gift to take advantage of the temporary effectively doubled BEA amount, you may want to take advantage of one of the bona-fide loan options discussed below. By initially structuring the transaction as a loan, you will retain the option to forgive part or all of loan in the future to effectively turn the loan into a gift at that time.

C. Low interest loans

The current historically low interest rates are the most important factor making this potentially the perfect time to undertake advanced estate planning. The simplest way to take advantage of these low interest rates is to make related party loans. As discussed in Part 1 of this newsletter series, these loans are required to have a minimum interest rate to avoid negative income and gift tax consequences under IRC Section 7872. These minimum interest rates change monthly and are referred to as the Applicable Federal Rates (AFRs). Loans up to a 3-year term use the short-term rate, loans up to a 9-year term use the mid-term rate, loans with terms over 9 years use the long-term rate, and certain statutorily approved transactions use the rate under IRC Section 7520, which is 120% of the mid-term rate (7520 rate). For July 2020, the short-term rate is 0.18%, the mid-term rate is 0.45%, the long-term rate is 1.17%, and the 7520 rate is 0.6%.

These type loans can be made for any legitimate purpose. For example, you can provide a lower cost mortgage to help your child with a home, you can help your child purchase a business, you can provide your child’s business with a needed cash infusion, or you can simply provide funds to your child to undertake all types of other investment activities.

For example, in July 2020, you loan $1 million to your child for a term of up to 9 years, interest paid annually with a balloon payment at the end of the chosen term. Your child would pay you interest of $4,500 annually and return the loaned funds by the end of the term. Now, let’s assume a very simple situation where your child invests the funds and averages a 7% annual simple interest rate of return on these funds over the term. In this case, your child will be earning $70,000 per year, which will net your child $65,500 annually after paying you the interest on the loan. In addition, your child will be paying income tax on this net earnings amount at your child’s likely lower income tax rates.

In summary, low interest loans allow you to shift excess earnings over the historically low AFR interest rate to your loved one without any wealth transfer tax effect and your loved one pays income tax on these excess earnings at their likely lower marginal income tax rates. From a non-tax perspective, these loans can be used to provide benefits to your loved ones at an historically low cost.

If instead the low interest loan is made to a grantor trust, you still get the same shifting of excess earnings over the historically low AFR interest rate to your loved ones in trust without any wealth transfer tax effect. However, you also get to make effective annual tax-free gift transfers to the trust by paying the income tax on the trust’s taxable income.

As discussed above, you may want to initially structure a large potential gift as a bona-fide loan transaction. By using this structure, you will have the flexibility to forgive part or all of loan in the future to effectively turn the loan into a gift at that time.

II. Refinance Existing Related Party Loans

You now have the enhanced ability to refinance existing related party loans and thereby lower the interest rate to an historically low AFR interest rate.

Most outstanding loans are still subject to significantly higher interest rates than exist today. In general, related party loans can be refinanced or modified to charge the current lower AFR interest rates. However, you need to be sure the lender has a legitimate reason for agreeing to modify the interest rate to the lender’s detriment. For example, such reason could be based on the terms of the existing promissory note (Note), it could be based on the borrower providing the lender with a significant principal payment, it could be based on differing payment terms more beneficial to the lender, or it could be based on the borrow providing additional security to help guarantee repayment.

These related party loans could include existing loans to loved ones, related business entities, or to trusts.

III. Grantor Retained Annuity Trusts (GRATs)

You now have the enhanced ability to remove most future income and appreciation on transferred assets from the gift and estate tax system by using Grantor Retained Annuity Trusts (GRATs).

Where utilizing a GRAT, you (grantor) transfer assets to a trust where you retain a set annuity type payment for a set term of years. At the end of the retained annuity term, any assets remaining in the trust either remain in trust for your loved ones or are distributed outright to loved ones. In most cases, the retained annuity payments are structured so their present value is close to the full value of the transferred assets, so you end up with little to no taxable gift amount. In general, this transaction removes wealth from the wealth transfer tax system to the extent the trust assets grow (income and appreciation) on a pre-income tax basis more than the 7520 rate. If the trust investments do not grow more than the 7520 rate, then all of the trust assets will end up being returned to you.

While not required, most GRATs are structured to be fairly short term in nature, for example, with 2 to 3 year retained annuity terms. The reasons for using a short retained annuity term include: (i) failure to survive the term effectively means that it did not end up providing any tax benefit; and (ii) if the GRAT investments fail to grow more than the 7520 rate, the GRAT assets will effectively be frozen in the GRAT structure until they are fully returned to the grantor via the annuity payments.

A common strategy is to create separate GRATs to hold different types of assets, and with the expectation that the annuity payments will get recontributed to new GRATs. This strategy is a combination of bifurcating investments in a series of rolling GRATs. The GRATs that own good to excellent investments are productive, and the GRATs with poor investments end up returning all of their assets back to the grantor. While this strategy does require some significant on-going administration, it can prove to be extremely beneficial with mostly good to excellent investments over time. With extremely low hurdle interest rates, an investment does not have to be exceptional to provide a significant benefit.

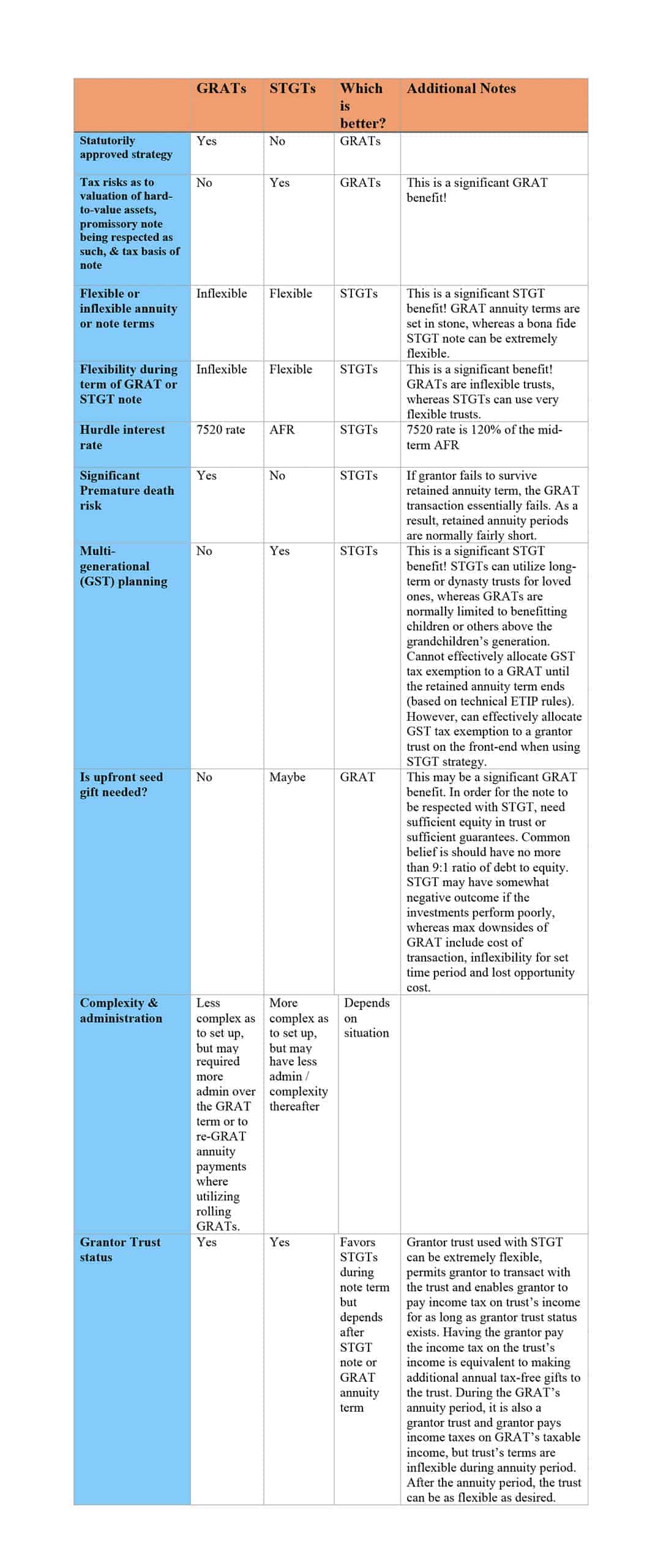

GRATs are often compared to sales to grantor trusts (STGTs). In general, STGTs are significantly more flexible and can, therefore, provide additional benefits. However, GRATs are simpler and come with less tax risk since they are a statutorily approved strategy, which can be important to the more risk averse, especially when planning to contribute hard-to-value assets.

We have provided a chart below showing the major differences between GRATs and STGTs.

IV. Sales to Grantor Trusts (STGTs)

You now have the enhanced ability to remove most future appreciation on transferred assets from the full wealth transfer tax system [including gift, estate, & generation skipping transfer (GST) taxes] by using STGTs.

Instead of contributing assets to a GRAT in return for a set stream of annuity payments, the STGT involves the sale of assets to a grantor trust in return for a normally flexible promissory note. In general, this transaction removes wealth from the wealth transfer tax system to the extent the trust assets grow (income and appreciation) on a pre-income tax basis more than the AFR.

We have provided a chart below showing the major differences between GRATs and STGTs.

V. Charitable Lead Annuity Trusts (CLATs)

You now have the enhanced ability to benefit loved ones while benefitting charity by using Charitable Lead Annuity Trusts (CLATs).

CLATs are similar to GRATs except that the upfront annuity payments pass to one or more charitable organizations instead of back to you, as the grantor. The assets remaining at the end of the annuity term, which is effectively the investment growth over the 7520 rate, passes to your loved ones outright or in trust. In effect, CLATs are GRATs for those that wish to benefit both charity and their loved ones as part of their estate planning.

CLATs are a more complex planning strategy, but they may provide significant income tax benefits in addition to significant gift and estate tax benefits.

If you would like to learn more about this important and timely topic, please call our offices at (678) 720-0750 or e-mail us at info@morgandisalvo.com to attend our upcoming webinar on July 21, 2020 and/or to schedule an estate planning consultation to discuss your particular situation.