By Loraine M. DiSalvo, Morgan & DiSalvo, P.C.

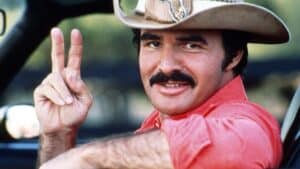

I was a Burt Reynolds fan since my dad took me to see “Smokey and the Bandit” way back when I was little, and I was sorry to hear of his death. This article about Burt Reynolds’s Will caught my eye, but I have some complaints about it.

I was a Burt Reynolds fan since my dad took me to see “Smokey and the Bandit” way back when I was little, and I was sorry to hear of his death. This article about Burt Reynolds’s Will caught my eye, but I have some complaints about it.

The article highlights some of the differences between a Will and a trust, and those statements are generally correct. However, the article does not make clear that there are different types of trusts and that the different types of trusts do not all provide the same benefits.

One example: The author states that a trust, unlike a Will, does not have to be offered for probate and that it can therefore keep the terms of the plan contained in the trust private. This is true, and either a revocable or an irrevocable trust can provide that benefit. However, the author then goes on to say that “[t]rusts also offer estate tax advantages in that, structured correctly, they remove assets from the decedent’s estate.” This is only partially true: some trusts, like a typical revocable trust, do not provide estate tax benefits beyond those which could be achieved with a Will. Even with irrevocable trusts, there are ones which do shelter assets from estate taxes in the creator’s estate, but there are other irrevocable trusts that don’t. It’s wrong to say that a trust that does not shelter assets from estate taxes in the creator’s isn’t “structured correctly”—whether a trust is structured correctly depends on what it is intended to accomplish. A typical revocable trust will not prevent its assets from being included in the creator’s estate for estate tax purposes, and it isn’t intended to do so.

A second example: the author also states that Mr. Reynolds was known to have had significant debt problems, and that a “properly constructed” trust can provide protection from its creator’s creditors. While yes, a “properly constructed” (and properly funded) trust may be able to provide some protection against creditors that the trust’s creator may have, a typical revocable trust often does not provide any protection against the creator’s creditors. Even an irrevocable trust may not provide protection against the creator’s creditors, depending on what control or beneficial interests the creator may have retained, where the trust is created, and where the trust’s creator lives. And, while an irrevocable trust that is created by the creator, during his lifetime, for the benefit of people other than the trust’s creator, and over which the creator retains only a few or no powers, may protect the trust’s beneficiaries against the creator’s creditors, fraudulent transfer theory may allow the creator’s creditors to attack the trust if the creator has too much debt, or retains too few assets, when the trust is created and funded and subsequently files for bankruptcy.

While I am generally happy to see articles that aim to educate the public about estate planning issues, and while I understand that the very limited amount of space that the author of this article (and many others like it) was likely given tends to mean that any discussion of issues must, by necessity, be highly simplistic, this article went too far in that direction. While, yes, most trusts help keep an estate plan private, not all trusts provide estate tax planning or creditor protection benefits. That was not made clear in this article.